Since this legal document is valid for up to 10 years and can be used to attach property not yet owned by the debtor, however, it may be wise to make this investment for future collection efforts. Most Houston business law professionals recommend determining if the debtor possesses any non-exempt property prior to paying the $205.00 fee to obtain a Writ of Execution.

This document allows creditors to place liens on any non-exempt property held by the debtor. Creditors can obtain a Writ of Execution 30 days after the judgment has been handed down and recorded.This documentation can be filed in multiple counties across the state of Texas however, a fee will usually be assessed for each filing instance. The creditor must then request and receive an Abstract of Judgment that can be filed with the County Clerk in the areas in which the debtor maintains property.First, the creditor must obtain a judgment in court that requires the debtor to pay the amount owed and any interest due on that amount.For other types of liens, the process typically involves the following steps: Judgments for unpaid child support, for instance, generally do not require a court order and may originate from the Texas Child Support Division. The procedure for filing a judgment lien varies depending on the type of property to be attached and the reason for the lien. Judgment liens can be attached to almost any other items of property and can remain in effect for 10 years or more, making them one of the most effective methods for enforcing a court-ordered settlement or judgment in the state of Texas. Up to $50,000 of personal property for an individual and up to $100,000 in personal items for a Texas family.Cemetery plots purchased and intended for use by the family.The primary residence of a debtor, generally referred to as a homestead.Some items of property are exempt from liens or seizure under Title 5, Subtitle A, Chapters 41 and 42 of the Texas Property Code: Sports cards, stamps and coin collections.Liens can be attached to almost any item of value, including the following: Property liens are filed with county or state officials and prevent the sale, transfer or disposal of certain items of property until a specific debt has been repaid.

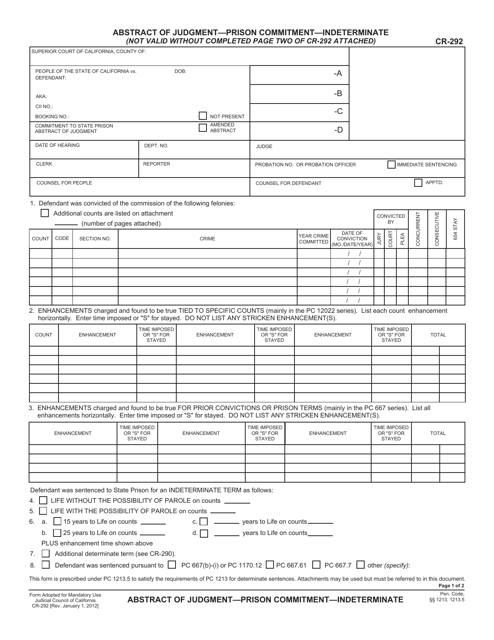

#Abstract of judgment texas professional

Firms with experience in Houston real estate law can provide professional guidance on property liens and how they can be used to collect on court-awarded settlements, child support payments and other debts incurred in the Lone Star State.

These liens may be placed on real estate holdings, vehicles and items of personal property to prevent their sale or disposal before the amounts owed have been paid. In the state of Texas, judgment liens are a legal method for enforcing decisions made in court.

0 kommentar(er)

0 kommentar(er)